The Three ESG Factors and What They Mean

ESG is short for Environment, Social and Governance. Often used interchangeably with sustainability reporting, it relates to a set of factors defining corporate responsibility. Let’s look at what each of these factors mean in the context of reporting.

ESG Reporting Fundamentals

Environment

The “Environment” component is centered around assessing a company’s impact on the natural world. It involves evaluating the organization’s efforts to mitigate environmental impact, protect biodiversity, promote sustainable resource management practices, and reduce their carbon footprint.

Social

The “Social” part of ESG is about the company’s treatment of people. This can be about a company’s impact and treatment of its stakeholders, including employees, communities, customers, and suppliers. It focuses on the social well-being, human rights, labor practices, diversity and inclusion, product safety, and community involvement of an organization.

Governance

Governance is one of the key components of the environmental, social,

and governance (ESG) framework. It refers to the way a company is

directed, controlled, and manages its operations. Good governance

focuses on promoting ethical behavior, transparency and accountability within an organization.

Unlock the Objectives of ESG Reporting

The objective of ESG reporting seeks to provide information on how well an organization is managing its environmental impact, social responsibilities, and corporate governance. By reporting on sustainability, companies aim to highlight their commitment to responsible development, diversity and inclusion, responsible supply chain management, and overall good governance practices. Companies with a good ESG rating are often more attractive to consumers, investors, and employees. Conversely, companies who run afoul of ESG regulations run the risk of incurring reputational damage and even legal penalties. ESG reporting aims to create a framework through which organizations can showcase their commitment to long-term value creation, fostering trust, and aligning their business strategies with sustainable development goals.

Get to Know Common ESG Reporting Frameworks

The ESG reporting landscape can be challenging to navigate, luckily there are several frameworks in place that aim to provide some level of standardization to this broad and complex topic. Of course, the existence of these frameworks is in itself a challenge, with the sheer number of differing guidelines making it hard to understand which ones are applicable. Let’s shed light on this and explore what all of these frameworks mean.

- Stands for Non-Financial Reporting Directive

- External auditing is optional

- Part of annual report

- Ends in 2024

- Stands for Corporate Sustainability Reporting Directive

- Replacing the NFRD

- Came into force 2023

- More specific reporting requirements

- External auditing is mandatory

- Requires digital tagging of data in accordance with ESEF

- Applies to more organizations (49,000 organizations, compared to 11,700)

- Part of management report

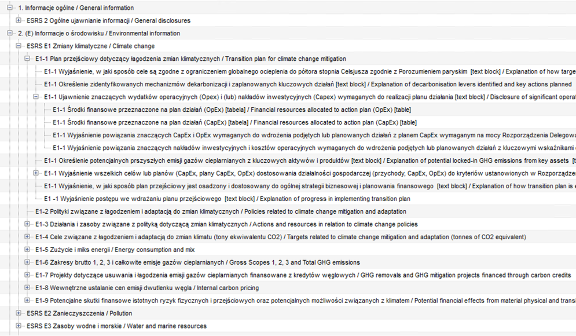

- Stands for European Sustainability Reporting Standards

- Supplementary part of CSRD, consisting of 12 standards

- ESRS 1 provides general guidelines with no specific requirements

- ESRS 2 is mandatory for all companies subject to CSRD

- All other requirements are subject to double materiality assessment.

- For the most part this is a voluntary framework however companies that are covered under the NFRD (and in future will be covered under CSRD) are required to disclose

- The framework is based around 6 objectives

1. Mitigation of climate change

2. Adaptation to the effects of climate change

3. Sustainable use and protection of water and marine resources

4. Transition to a circular economy

5. Pollution prevention and control

6. Protection and restoration of biodiversity and ecosystems - Within this framework, there are 3 KPIs that must be reported on:

1. Turnover: What percentage of company turnover is compliant with the taxonomy objectives

2. CapEx: What percentage of the company’s Capital Expenditure, for example physical assets such as buildings or machinery, are compliant with taxonomy objectives

3. OpEx: What percentage of the company’s Operating Expenditure, such as employee salary, utilities, etc, are compliant with taxonomy objectives - In addition to the 6 objectives and 3 KPIs, it is also categorized by the Do No Significant Harm (DNSH) objective, meaning that the harm brought forth by any company initiative cannot outweigh the benefits.

Two standards created on 26 June 2023 by the International Sustainability Standards Board (ISSB). Meant to be enforced in tandem however cover different areas.

IFRS S1

Comprised of basic standards for sustainability reporting. Requires the Disclosure of material information about sustainability-related risks and opportunities alongside financial statements. Industry-specific disclosures must be utilized in addition to SASB standards for guidance. Must refer to external sources for identifying sustainability-related risks and opportunities (excluding IFRS S2) Provision of disclosures that connect sustainability-related risks and opportunities with financial statements. Not restricted by GAAP requirements.

IFRS S2

Strategy disclosures must be distinguished between physical and transitional risks. Disclosure of plans to address climate-related risks and opportunities, including compliance with legal and regulatory targets. Conducting of scenario analysis to explain potential impacts of climate-related events on the business. Inclusion of climate-related metrics and targets such as greenhouse gas emissions (cross-industry), industry-based metrics, and company-specific metrics used by the board or management for progress measurement.

Who's Obliged to Report on ESG?

With the implementation of CSRD, the reporting scope is set to expand significantly compared to the NFRD. While only 11,000 companies were previously mandated to report under the NFRD, the introduction of new reporting requirements means that approximately 50,000 companies will now be affected.

CSRD Timeline

SmartESG Reporting

The objective of ESG reporting seeks to provide information on how well an organization is managing its environmental impact, social responsibilities, and corporate governance.

By reporting on sustainability, companies aim to highlight their commitment to responsible development, diversity and inclusion, responsible supply chain management, and overall good governance practices. Companies with a good ESG rating are often more attractive to consumers, investors, and employees. Conversely, companies who run afoul of ESG regulations run the risk of incurring reputational damage and even legal penalties.

ESG reporting aims to create a framework through which organizations can showcase their commitment to long-term value creation, fostering trust, and aligning their business strategies with sustainable development goals.

Why struggle with ESG reporting? Collect data, analyze information, and produce fully compliant reports – all at the touch of a button.

ESG reporting simplified

User-friendly interface and templates aligned with global standards give you everything you need to gather, organize, and report data on your environmental, social, and governance practices. With more accuracy and reliability in your disclosures, you can make informed decisions, measure performance, and showcase your sustainability initiatives with confidence.

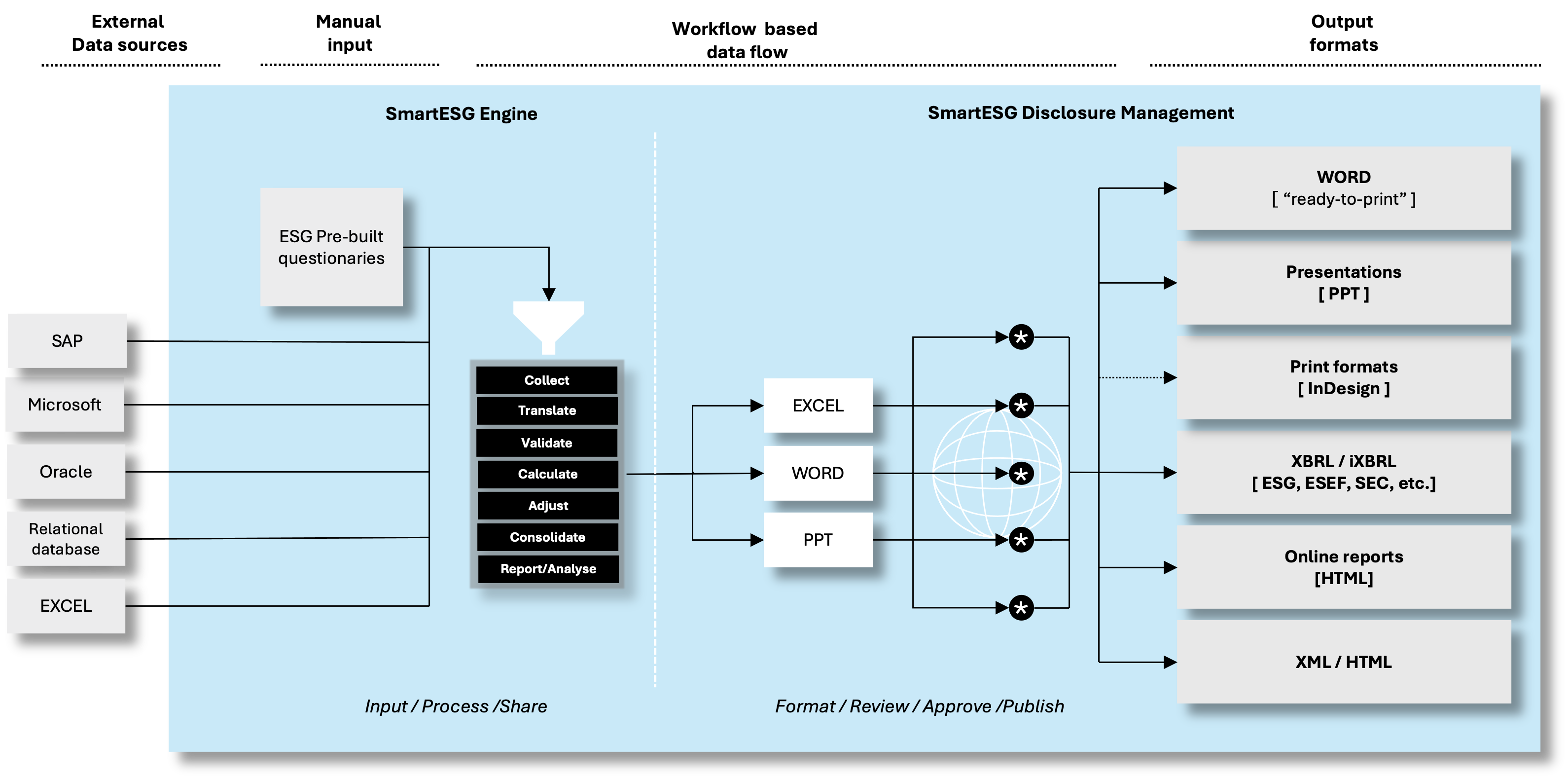

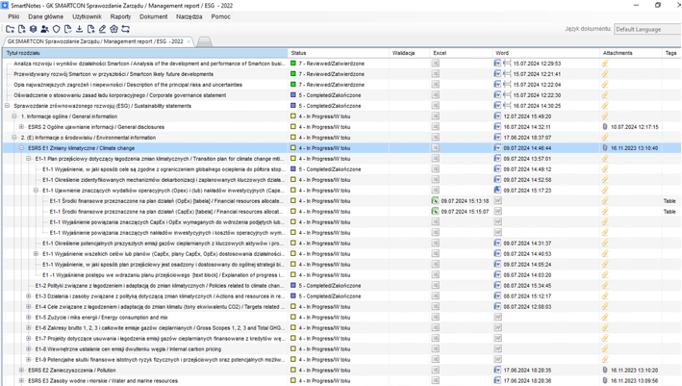

True end-to-end solution with two functional parts: SmartESG Engine for data management (gathering, analysing, validation and reporting) and SmartESG Disclosure Management for the final preparation of ESG report in the iXBRL format according to CSRD requirements.

SmartESG key functionalities

- data completeness

- data integrity

- validation of data on entity or aggregated level

- validation at the data entry stage

- input

- submission

- validation

- review

- approval

- consolidation

- Reports/analysis may be created by each user (no need of IT knowledge)

- Reports/analysis may be shared with other users

- Double-click to invoke the Ad Hoc analysis grid

- Display Point of View member selector

- Drag and drop members from Point Of View (POV) to grid

- Set default POV by the user

- Zoom in and zoom out capabilities on dimension members (by double-click)

- Drill-through

- Pivot dimension members to columns or rows (drag and drop)

- Display cell text

- Submit data

- Keep only or remove only certain data cells

- Calculate and consolidate data commands

- Specify member display options (e.g. account number, account description or both)

- VBA functions, which support customization and automation of Smart View commands using Visual Basic for Application function

FAQ Overview

Is ESG Mandatory?

In the past, ESG disclosures were done on a voluntary basis however the latest frameworks make reporting for in-scope companies compulsory.

Is CSRD applicable to non-EU companies?

If your company is based in the EU, has significant operations in the region or is the parent company of a subsidiary in the region that meets the requirements then you are subject to CSRD.

Why ESG is important?

As of the European Green deal, many countries across the world have demonstrated a commitment to be climate-neutral by 2050, also referred to as net zero. This is also inline with a wider cultural awareness of the effects of climate change, leading to greater consumer demand for more environmentally responsible companies. Robust ESG reporting is therefore important not only for regulatory compliance but can also make your company more attractive to investors and customers.

What is greenwashing?

Greenwashing is the act of using deceptive marketing to falsely present your organization’s values or actions to be more environmentally friendly. This is something that ESG reporting aims to curb, providing transparency into company practices.

Who is responsible for ESG within an organisation?

Because so much of ESG data is intwined with financial data, it’s common for sustainability reporting to be responsibility of the CFO, however this is not a firm rule. Some organizations may appoint an ESG executive to take charge of sustainability disclosures and other ESG initiatives, allowing them to have it as their sole focus. However your organization chooses to tackle it, it is important to remember that ESG is something that the whole company should be invested in.

What are the challenges with ESG reporting?

The biggest challenges related to ESG reporting are in data collection. Because the reporting scope is so broad, it’s common for the data to be housed in isolated data silos, making it hard to aggregate all the necessary information. The latest directives also enforce digital tagging of data to make it machine readable, something that necessitates specific software with iXBRL tagging functionality.